During this time where students may face massive loan debt and other financial burdens, professionals and current research offer students some tips to manage their finances.

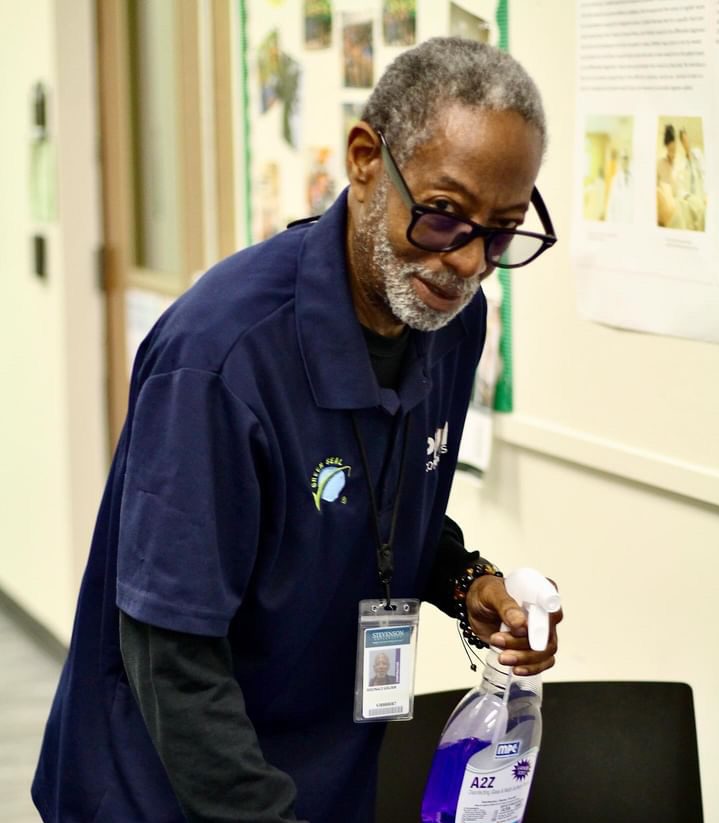

According to Student Loan Hero, student loan debt statistics for 2020 show that in the United States. there is a total of $1.64 trillion of student loan debt. Dennis Starliper, a retired banking executive and an adjunct professor of accounting at Stevenson, offers some advice on how students can learn to manage their money.

Starliper noted that the most practical and easiest way to manage money is to create a budget. Create a schedule of income each month, and then schedule how much is needed to spend to ensure that spending does not exceed income, said Starliper. “Discipline is perhaps the greatest challenge to this process,” he added.

College Info Geek published a 2019 article written by Thomas Frank about how to budget as a college student, which explained that there are no cheat codes in real life to make things easier. But after clearly defining goals and adjusting spending habits, Frank added that there shouldn’t be a ton of thought put into budgeting; it should be simple, more of a background process in your head.

Frank helps readers define their financial goals, do a “financial SWOT test,” create their own personal money pipeline, showing how they can automate most of the payment process, and offers advice on credit cards and guidelines for cutting spending habits.

Students should aim to pay off their debt as much as possible during college. Paying the minimums and the highest interest-rate loans first is best practice, said Frank.

Mint, a free online budget tracker and planner application that can be downloaded onto a mobile device, is a great tool to help track progress and stay motivated, added Frank.

Starliper advises students to consider paying off their loans with any monetary gifts they receive while a student. Otherwise, students can consider paying loans off when they secure a paying job after college, he added.

Students are also encouraged to save as much as they can during college. “Consider savings as a process to defer purchasing power into the future,” said Starliper.

The option to invest should also be an choice. Where students decide to invest is a function of how much risk they are willing to assume, said Starliper. A high-risk investment implies a lack of concern about losing the money invested, added Starliper.

If students wish to know more about investing, Frank goes into more detail about exactly how they can do this.

Many students work during college, but the most reasonable way to produce income is to simply work hard during the summer when classes are not in session, said Starliper. “Unless you are unusually gifted, working while studying lowers the success probability of your learning as well as job productivity,” he explained.

Students may be concerned about their current financial situations, especially with the COVID-19 outbreak, and are encouraged to reach out to faculty or staff. A student should consider faculty whom they trust the most, said Starliper. “Contact them. Most will be more than willing to help,” he added. The financial aid office at Stevenson continues to take calls as well.